Introduction

Cost estimation is one of the most critical processes in construction, manufacturing and engineering projects.

Accurate cost estimation helps organizations in budgeting, planning, and controlling project costs, improve profitability, reduce financial risks and ensure successful project execution.

In this article, we explain what is cost estimation, its meaning, commonly used methods, core principles and key factors that affect accurate cost estimation with practical insights for real-world projects.

What is Cost Estimation?

Cost estimation is the process of calculating the total expected cost of a project by analyzing material quantities, labor requirements, equipment usage, overheads, taxes and profit margins before execution.

Quick Answer: Cost estimation is the process of forecasting project expenses before execution to support planning, budgeting, and decision-making.

Cost Estimation Process – Step by Step Guide

Main Objective of Cost estimation is a systematic approach to identifying all applicable value-added processes and activities and predicting the total cost required to complete these activities of a project within defined scope, quality and time constraints.

It includes the calculation of: Material cost, Labor cost, Equipment & machinery cost, Overheads, Taxes (GST/VAT), Profit margins and Contingencies

A practical step-by-step cost estimation Process:

Below are the Main Cost Estimation Process

Define project scope and specifications

Prepare quantity take-off (BOQ)

Analyze material, labor, and equipment rates

Calculate direct and indirect costs

Add overheads, profit, and taxes

Finalize total project cost

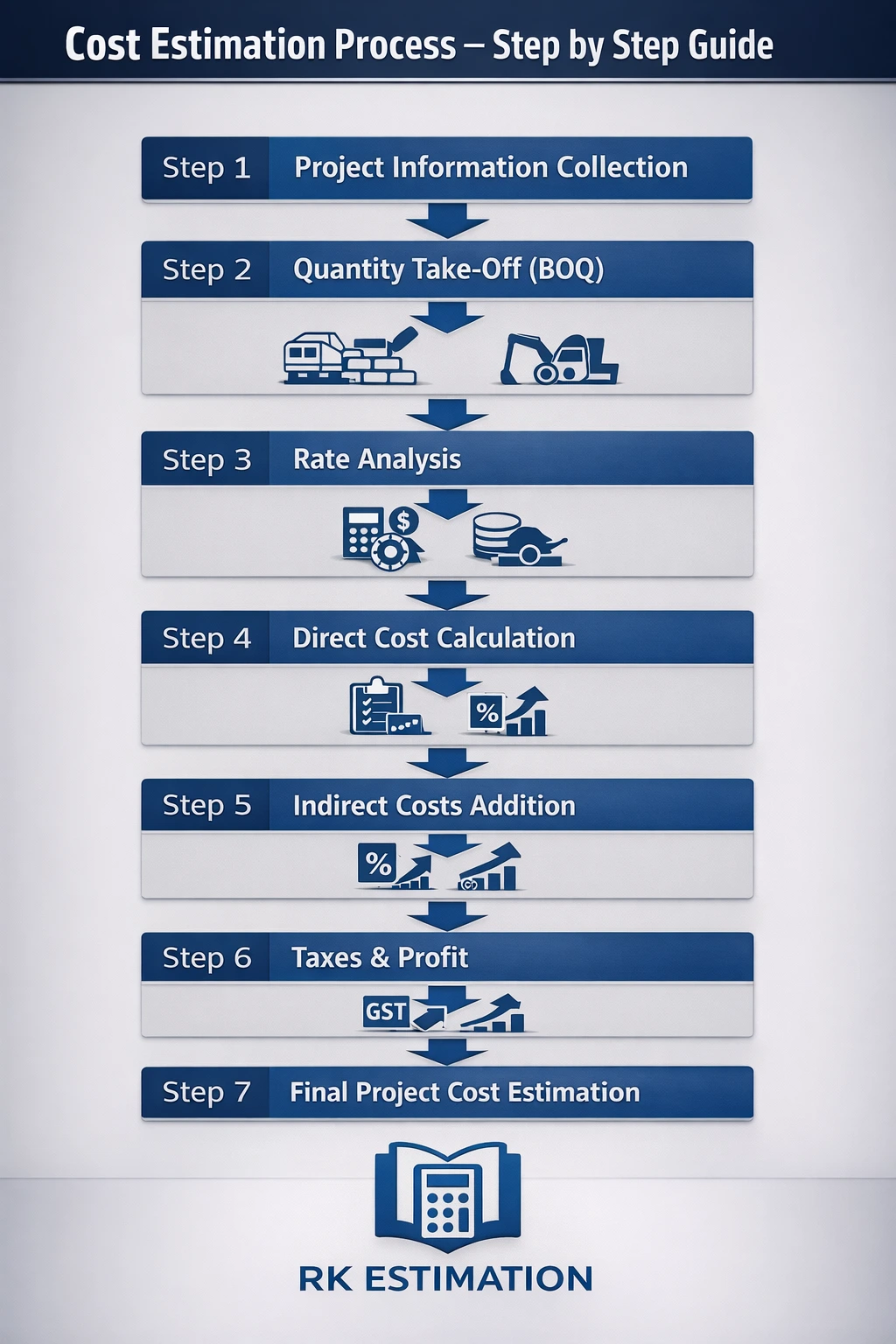

Step01: Define project scope and specifications

Project Information Collection Step includes Feasibility review and defining Project Scope by analyzing:

- • Drawings

- • Specifications

- • Scope definition

Step02: Prepare quantity take-off (BOQ)

In this Step we prepare BOQ, and other detailing work based on Drawings, Specifications and Scope definition and includes:

- • Material quantity

- • Labor quantity

- • Equipment requirement

Step03: Analyze material, labor, and equipment rates

In this Step we do Rate Analysis for identified Material, Labor, Processes and Equipment's and includes:

- • Material rate

- • Labor rate

- • Machinery cost

Step04: Direct Cost Calculation

In this Step we calculate Direct Material cost, Direct Labor cost and Direct Equipment cost. Below are the Practical Formulas used to Calculate Direct Costs.

- • Direct Material cost: Material Cost = Quantity × Rate

- • Direct Labor cost: Labor Cost = No. of Workers × Wage Rate × No. of Days

- • Direct Equipment cost: Equipment Cost = Hourly Rate × Operating Hours

- Direct Cost = Material Cost + Labor Cost + Equipment Cost

Step05: Indirect Cost Addition (Overhead)

Indirect expenses are incurred to operate whole business not on a specific job so it cannot be charged directly to a product. These are ongoing operational cost and charged as Overhead of the business. Example of Indirect expenses: Advertising, employee salaries, utilities, rent of building, insurance premium, depreciation, Telephone bill.

- • Overheads: Overhead = Direct Cost × Overhead %

Step06: Profit & Taxes

This is Final cost incurred in cost estimation as per below:

- • Profit margin (%): Profit = Direct Cost × Profit %

- • GST (%): GST = (Direct Cost + Overhead + Profit) × GST %

Step07: Final Project Cost Estimation

Total Project Cost = Direct Cost + Overhead + Profit + GST

Try Our Free Online Cost Estimation Calculator

Instantly calculate material, labor, overhead, GST, and profit for your project with RK Estimation tools.

Types of Cost Estimation

1. Preliminary (Rough) Cost Estimation

Preliminary (Rough) Cost Estimation type used at the concept or planning stage based on:

Unit cost method

Past project data

Plinth area

👉 Accuracy: ±20–30%

2. Detailed Cost Estimation

Detailed Cost Estimation Prepared after final drawings and specifications are available. Includes:

BOQ (Bill of Quantities)

Material take-off

Rate analysis

👉 Accuracy: ±5–10%

3. Revised Cost Estimation

Revised Cost Estimation prepared when:

Project scope changes

Quantity variation occurs

Market rates fluctuate

4. Supplementary Cost Estimation

Used for additional works not included in the original scope.

Cost Estimation Methods

1. Analogous Estimation

Analogous estimation estimates project cost by comparing it with the cost of a similar completed project. Analogous Estimation based on historical project data. it is Fast, less detailed and Suitable for early planning.

Example: Fabrication Work of a steel shed of 100 MT earlier cost ₹80,000/MT.

A similar shed of 110 MT is planned. Estimated cost ≈ ₹88 lakh using the same rate.

2. Parametric Estimation

Parametric Estimation uses statistical relationships and highly effective for large-scale projects. Parametric estimation estimates fabrication cost using a predefined cost per unit such as ₹/m², ₹/MT or man-hours per MT.

Why Parametric Estimation Works Well in Fabrication

- Fast and data-driven

- Ideal for budgeting & bidding stage

- Easy to update when rates change

Example: Parametric Estimation in Steel Fabrication of structural steel work = 80 MT

Step 1: Identify Cost Parameter

From past completed projects: Average fabrication cost = ₹70,000 per MT

(This rate includes cutting, welding, grinding, painting, and shop overheads.)

Step 2: Apply Parametric Formula

Estimated Cost=Quantity × Cost per Unit

=80 MT×₹70,000/MT=₹56,00,000

Final Estimated Fabrication Cost=₹56 lakh

Another Quick Example (Man-Hour Based)

Data: Standard productivity = 25 man-hours / MT, Labor rate = ₹500 / hour, Quantity = 40 MT, Labor Cost=40×25×500=₹5,00,000

3. Bottom-Up Estimation

Bottom-up estimation calculates total cost by estimating each work activity separately and then adding them together. It used in detailed BOQ-based estimation.

Why This is Bottom-Up

Each activity is estimated individually and Cost calculated item-wise

Costs are Aggregated and summed to get total project cost

Most accurate method

Practical Example: Bottom-Up Estimation in Steel Fabrication of a 30 MT structural steel platform.

Step 1: Break Work into Activities

| Activity | Quantity / Basis | Rate | Cost |

|---|---|---|---|

| Cutting | 30 MT | ₹3,000 / MT | ₹90,000 |

| Welding | 30 MT | ₹8,000 / MT | ₹2,40,000 |

| Painting | 30 MT | ₹2,000 / MT | ₹60,000 |

| Erection | 30 MT | ₹5,000 / MT | ₹1,50,000 |

Step 2: Add All Activity Costs

Total Fabrication Cost=90,000+2,40,000+60,000+1,50,000=₹5,40,000

Final Estimated Cost= ₹5.4 lakh

4. Three-Point Estimation

Three-point estimation in fabrication uses optimistic, most likely, and pessimistic costs to produce a realistic project estimate. It Reduces risk uncertainty.

Practical Example: Three-Point Estimation in Steel Fabrication of a structural steel frame (50 MT) including cutting, welding, and erection.

Step 1: Define Three Estimates

| Estimate Type | Description | Cost |

|---|---|---|

| Optimistic (O) | Smooth work, no rework, stable steel prices | ₹45,00,000 |

| Most Likely (M) | Normal productivity, minor delays | ₹50,00,000 |

| Pessimistic (P) | Rework, material price rise, labor issues | ₹60,00,000 |

Step 2: Apply Three-Point (PERT) Formula

= (645,00,000+(4×50,00,000) +60,00,000)/6

=63,05,00,000/6 =₹50,83,000 (approx.)

Final Estimated Fabrication Cost

Approx. ₹50.8 lakh

Why This is Useful in Fabrication

Accounts for material price fluctuation

Considers welding rework risk

Reduces under-quoting in tenders

Principles of Cost Estimation

1. Accuracy: Estimation must reflect real market conditions.

2. Completeness: All cost elements must be included (direct + indirect).

3. Consistency: Uniform measurement units and rate sources.

4. Transparency: Clear assumptions and calculation logic.

5. Flexibility: Ability to revise estimates as project conditions change.

Key Factors Affecting Cost Estimation

1. Material Specifications & Grades: Different grades significantly impact cost.

2. Labor Productivity: Skill level, location, and work conditions affect labor rates.

3. Market Price Fluctuation: Steel, cement, fuel prices directly influence estimates.

4. Project Location: Transportation, accessibility, and local regulations.

5. Construction Method: Manual vs mechanized work.

6. Project Duration: Longer duration increases overhead and indirect costs.

7. Wastage & Loss Factors: Material wastage must be realistically considered.

8. Taxes & Statutory Charges: GST, royalty, duties, and local taxes.

Common Mistakes in Cost Estimation

Ignoring indirect costs

Underestimating wastage

Using outdated rates

Missing BOQ items

Overlooking escalation factors

Incorrect unit conversions

Best Practices for Accurate Cost Estimation

✅ Use updated market rates

✅ Follow standard measurement codes

✅ Use BOQ-based calculations

✅ Apply realistic productivity norms

✅ Include contingency provisions

✅ Use digital estimation tools & calculators

Frequently Asked Questions (FAQs)

To forecast project costs accurately and control financial risks.

Bottom-up estimation is the most accurate when detailed data is available.

Direct costs relate to materials and labor, while indirect costs include overheads, supervision, and administration.

Accurate cost estimation helps to:

Control project budgets

Avoid cost overruns

Improve tender accuracy

Compare project feasibility

Enhance profit planning

Support financial approvals

Improve client confidence

Conclusion

Cost estimation is the backbone of successful project planning and execution. Understanding its meaning, methods, principles, and key influencing factors allows engineers, contractors, and project managers to make informed decisions, minimize risks, and maximize profitability.

With the right approach, tools, and experience, cost estimation becomes a powerful control mechanism rather than just a budgeting exercise.