Material Costing

Material costing plays a critical role in determining the overall manufacturing cost of any product.

Understanding various cost factors helps businesses improve pricing accuracy, control expenses and boost profitability.

This guide breaks down the key elements that influence material costing along with practical insights for better estimation.

What is Material Costing?

Material costing is the process of calculating the total cost of raw materials required for manufacturing a product.

It includes direct material cost, associated handling and storage expenses, wastage and supplier-related charges.

Accurate material costing helps ensure competitive pricing, reduces cost overruns and supports efficient project planning.

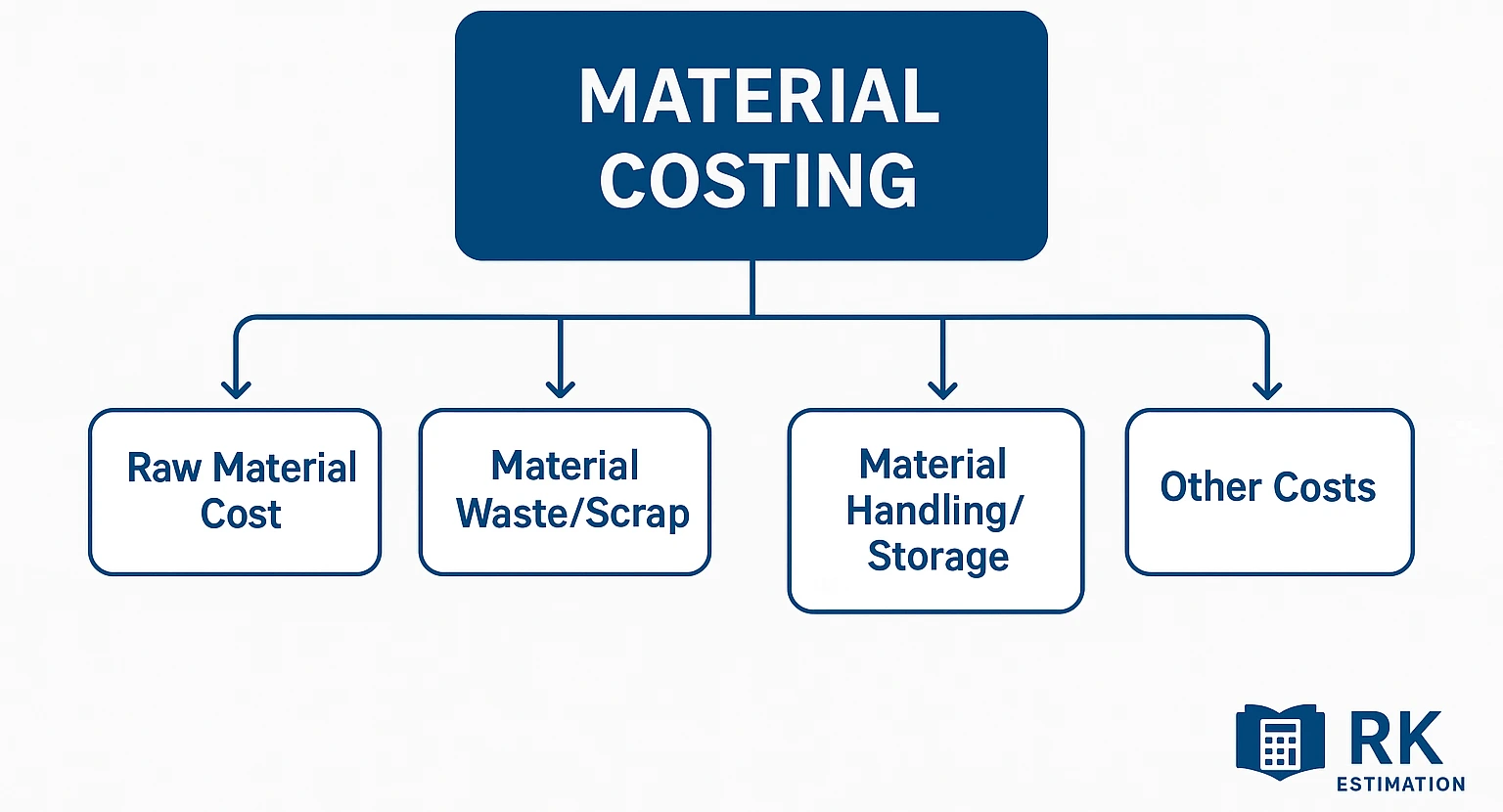

Components of Material Costing

To understand material costing properly, it’s important to break down what goes into the total material cost. The total material cost is the sum of all these expenses

1. Purchase Cost

The price paid to suppliers for raw materials.

2. Transportation Cost

The expenses of bringing materials to the factory or site.

3. Storage and Handling Costs

Costs associated with warehousing, maintaining and handling materials.

4. Insurance and Taxes:

Any duties, insurance or taxes paid on materials.

5. Wastage or Scrap

Losses due to waste, damage or defects during processing.

Key Cost Factors in Material Costing:

1. Raw Material Base Price

- Primary cost paid to suppliers

- Influenced by market rates, material grade, chemical composition, and global supply-demand trends.

- Review main factors affecting Material Specification & Grade Selection

Main Factors Affecting Material Specification & Grade Selection in Construction & Fabrication:

Click below Button

Material Specification & Grade Selection

2. Material Wastage / Scrap Allowance

- Cutting loss, machining loss, rejection, and handling damage.

- Must include an additional percentage based on material type (e.g., steel plates, pipes, castings).

3. Material Dimensions & Weight

- Cost is typically calculated per kg, per meter, or per piece.

- Weight depends on density, thickness, cross-section, and shape.

How to Calculate weight of Material:

Fill details in below calculator to calculate weight of Steel plate (Density of Steel plate 7850 kg/m3).

For other material, fill details in below calculator with density of that Material which weight need to be calculated.

4. Handling & Storage Cost

- Loading/unloading chargers

- Storage facility, climate control, racks

- Internal transportation (forklift, crane)

5. Supplier Lead Time & Availability

- Long lead time materials add risk and buffer cost.

- Availability affects working capital and inventory cost.

6. Freight & Logistics Charges

- Transportation cost from supplier to site.

- Includes packing, forwarding, insurance, and freight.

7. Material Certification & Testing Cost

- Mill test reports (MTR), NABL test certificates

- Third-party inspection charges (TPI)

- Material traceability requirements (heat numbers, batch codes)

8. Import Duties & Taxes

- GST, customs duty, anti-dumping duty

- Port charges, clearance cost

- FX rate fluctuations for imported materials

9. Minimum Order Quantity (MOQ)

- Higher MOQ increases working capital and storage cost.

- Impacts bulk buying strategies.

10. Material Substitutes / Alternatives

- Cost difference between standard, premium, and substitute materials.

- Engineers may approve alternate materials to reduce cost.

Steps to Calculate Material Cost:

Below are the main steps to calculate material cost:

- Identify material specification and grade

- Determine required quantity (net + wastage)

- Calculate weight or volume

- Add base price

- Add freight, taxes, packing, duties

- Add testing & certification cost

- Add handling & storage cost

- Final material cost per unit or per project

How to Calculate Landed Material Cost:

Click below Button

How to Calculate Material Cost (Step-by-Step Guide)

Tips for Reducing Material Cost

- Optimize cutting layout to reduce scrap.

- Negotiate long-term rate contracts with suppliers.

- Use bulk procurement when feasible.

- Explore alternate materials approved by design.

- Implement inventory control (FIFO, EOQ).

- Monitor global material rate trends.

Tips for Effective Material Costing

- Collect and record material expenditure and market price of raw material.

- Review market trends for price fluctuations.

- Implement waste control measures to minimize scrap cost and losses to increase profit margin.

- Compare actual expanses and raw material rate with cost considered during estimation on regular interval.

- Need to estimate accurate material cost. Low material estimation will reduce profit margin while high material estimation increases price of product.

- This provides basis to revise material cost of existing part as well as new product cost estimation

Try Our Free Online Cost Estimation Calculator:

Click below Button

Importance of Material Cost

Material costing is a strategic tool for decision-making. Here’s why it matters:

Helps Set Competitive Prices: Knowing the exact cost of materials ensures fair and profitable pricing.

Improves Cost Control: Identifies wastage and inefficiencies in material usage.

Supports Budgeting: Helps forecast future material expenses accurately.

Assists in Profit Planning: Determines how material costs affect overall profitability.

Enhances Decision-Making: Informs make-or-buy decisions and supplier negotiations

Type of Material Cost

Material costing is a strategic tool for decision-making. Here’s why it matters:

Material cost divided in two types:

- Direct Material cost &

- Indirect Material cost

Direct Material Cost:

A direct material is one which directly processed and converted into salable product and the amount paid for direct material in known as direct material cost.

Example: Mild steel Plate, Rod, Angle, Beam, Paint, Plastic sheet etc.

Indirect Material Cost:

An indirect material is one which directly not used in the product but necessary for the production process and the amount paid for indirect material in known as indirect material cost.

Example: Cotton waste, Grease, oil, cutter, coolant, hand gloves etc.

Procedure to calculate Direct Material cost:

- Prepare list (Bill of Material) of all parts.

- Calculate weight of each part (Example: unit in kg).

- Collect rate of raw material (Example: unit in Rs/kg).

- Calculate cost of each part (in Rs.) by multiply (Weight*Rate*Qty.)

- Calculate direct material cost by adding each cost.

Conclusion

Material costing is a crucial component of project estimation and manufacturing economics. By understanding each cost factor, businesses can make better purchasing decisions, minimize waste, and improve profitability.