Labor Based Costing is a fundamental costing method used in manufacturing, fabrication, construction and service industries where labor cost is a major contributor to total project cost.

This method focuses on accurately calculating labor hours, wage rates, productivity and associated overheads to determine the true cost of work.

In this blog, we will explain what labor-based costing is, its importance, a step-by-step process and a practical calculation example to help estimators, engineers and project managers prepare accurate cost estimates.

What is Labor Based Costing?

Labor Based Costing is a costing technique where the primary cost driver is labor hours or labor rate.

The total cost is calculated by multiplying required labor hours by applicable wage rates, including allowances, benefits and indirect labor costs.

This method is widely used when:

- Work is manpower-intensive

- Machine usage is limited

- Productivity varies based on skill level

Importance of Labor Based Costing

Labor based costing helps organizations to:

- Prepare accurate project estimates

- Control labor productivity and efficiency

- Avoid cost overruns

- Improve pricing and bidding accuracy

- Monitor actual vs estimated labor performance

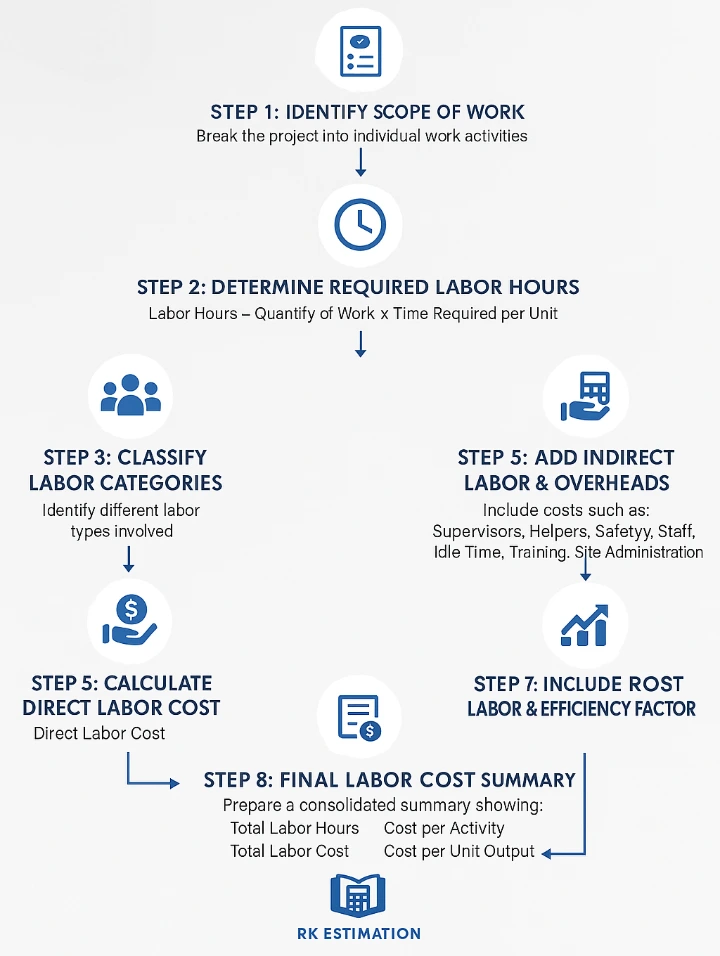

Step-by-Step Process of Labor Based Costing

Step 1: Identify Scope of Work

To identify scope of work, break the project into individual work activities, such as:

- Cutting

- Welding

- Assembly

- Installation

- Finishing

Each activity should be measurable and clearly defined.

Step 2: Determine Required Labor Hours

Estimate the standard labor hours required for each activity based on:

- Historical data

- Productivity norms

- Industry benchmarks

- Past project experience

Formula: Labor Hours = Quantity of Work × Time Required per Unit

Table 1: Activity-Wise standard labor hours Calculation

| Activity | Quantity | Time per Unit (Hr) | Total Labor Hours |

| Cutting | 100 | 0.2 | 20 |

| Welding | 100 | 0.3 | 30 |

| Assembly | 100 | 0.15 | 15 |

| Total Hours | 65 |

Purpose: Calculates standard labor hours without productivity losses or gains.

Step 3: Classify Labor Categories

Identify different labor types involved:

- Skilled labor

- Semi-skilled labor

- Unskilled labor

- Supervisory staff

Each category may have a different wage rate.

Step 4: Determine Labor Rates

Calculate hourly labor rates including:

- Basic wage

- Overtime allowance

- PF / ESI / statutory benefits

- Incentives

- Welfare expenses

Formula:

Hourly Labor Rate = Total Monthly Cost ÷ Working Hours per Month

Hourly Labor Rate = Monthly Salary / (Working Days * Hours per Day)

Table 2: Labor Category & Hourly Rate Calculation

| Labor Type | Monthly Salary | Working Days | Hours/Day | Hourly Rate |

| Skilled | 52000 | 26 | 8 | 250 |

| Semi-Skilled | 41700 | 26 | 8 | 200 |

| Unskilled | 17600 | 26 | 8 | 85 |

Purpose: Converts monthly wages into hourly labor rates.

Step 5: Calculate Direct Labor Cost

Multiply labor hours by labor rate for each category.

Formula: Direct Labor Cost = Labor Hours × Hourly Rate

Table 3: Direct Labor Cost Calculation

| Labor Type | Labor Hours | Hourly Rate | Direct Labor Cost |

| Skilled | 30 | 250 | 7500 |

| Semi-Skilled | 15 | 200 | 3000 |

| Unskilled | 5 | 85 | 425 |

| Total Direct Labor Cost | 10500 |

Step 6: Add Indirect Labor & Overheads

Include costs such as:

- Supervisors

- Helpers

- Safety staff

- Idle time

- Training

- Site administration

These can be added as:

- Percentage of direct labor cost, or

- Fixed cost per hour/day

Table 4: Indirect Labor & Overhead Cost

(Total 15% of Direct Labor cost in Below case)

| Description | Percentage | Cost (₹) |

| Supervision | 8% | 840 |

| Safety & Welfare | 4% | 420 |

| Idle Time | 3% | 315 |

| Total Indirect Cost | 15% | 1575 |

Step 7: Include Productivity & Efficiency Factor

Adjust labor hours for:

- Learning curve

- Site conditions

- Skill variation

- Weather or shift work

Formula: Adjusted Labor Hours = Estimated Hours × Productivity Factor

Formula: Adjusted Labor Hours=Quantity * Time per Unit * Productivity Factor

Table 5: Activity-Wise Adjusted Labor Hours Calculation

| Activity | Quantity | Time per Unit (Hr) | Productivity Factor | Total Labor Hours |

| Cutting | 100 | 0.2 | 1.05 | 21 |

| Welding | 100 | 0.3 | 1.1 | 33 |

| Assembly | 100 | 0.15 | 1 | 15 |

| Total Hours | 69 |

Purpose: Calculates adjusted labor hours considering productivity losses or gains.

Step 8: Final Labor Cost Summary

Prepare a consolidated summary showing:

- Total labor hours

- Cost per activity

- Total labor cost

- Cost per unit output

Formula: Final Labor Cost per Unit=Total Labor Cost / Total Quantity

| Total Direct Labor Cost (₹) | 10500 |

| Total Indirect Labor Cost (₹) | 1575 |

| Total Labor Cost (₹) | 12075 |

| Total Quantity Produced | 100 |

| Labor Cost per Unit (₹) | 120.75 |

Labor Based Costing – Practical Calculation Example

Example: Fabrication of 100 steel brackets

Given:

- Labor time per bracket = 0.5 hours

- Total quantity = 100 brackets

- Skilled labor rate = ₹300/hour

- Indirect labor overhead = 15%

Step-by-Step Calculation:

1. Total Labor Hours=100 × 0.5 = 50 hours

2. Direct Labor Cost=50 × ₹300 = ₹15,000

3. Indirect Labor Cost=15% of 15,000 = ₹2,250

4. Total Labor Cost = ₹15,000 + ₹2,250 = ₹17,250

5. Labor Cost per Unit= ₹17,250 ÷ 100 = ₹172.50 per bracket

Advantages of Labor Based Costing

- Simple and transparent method

- Suitable for manpower-intensive projects

- Easy to monitor and control

- Improves labor productivity tracking

Limitations of Labor Based Costing

- Less accurate for machine-driven operations

- Highly dependent on productivity assumptions

- Requires accurate labor time estimation

Where Labor Based Costing Is Commonly Used

- Fabrication & welding shops

- Construction projects

- Maintenance work

- Repair & job work costing

- Small and medium manufacturing units

Conclusion

Labor Based Costing is a powerful and practical costing method when labor plays a dominant role in production or project execution.

By following a step-by-step approach and using realistic labor rates and productivity factors, businesses can achieve accurate cost estimation and better cost control.

At RK Estimation, we help professionals understand and apply practical costing methods for real-world projects.